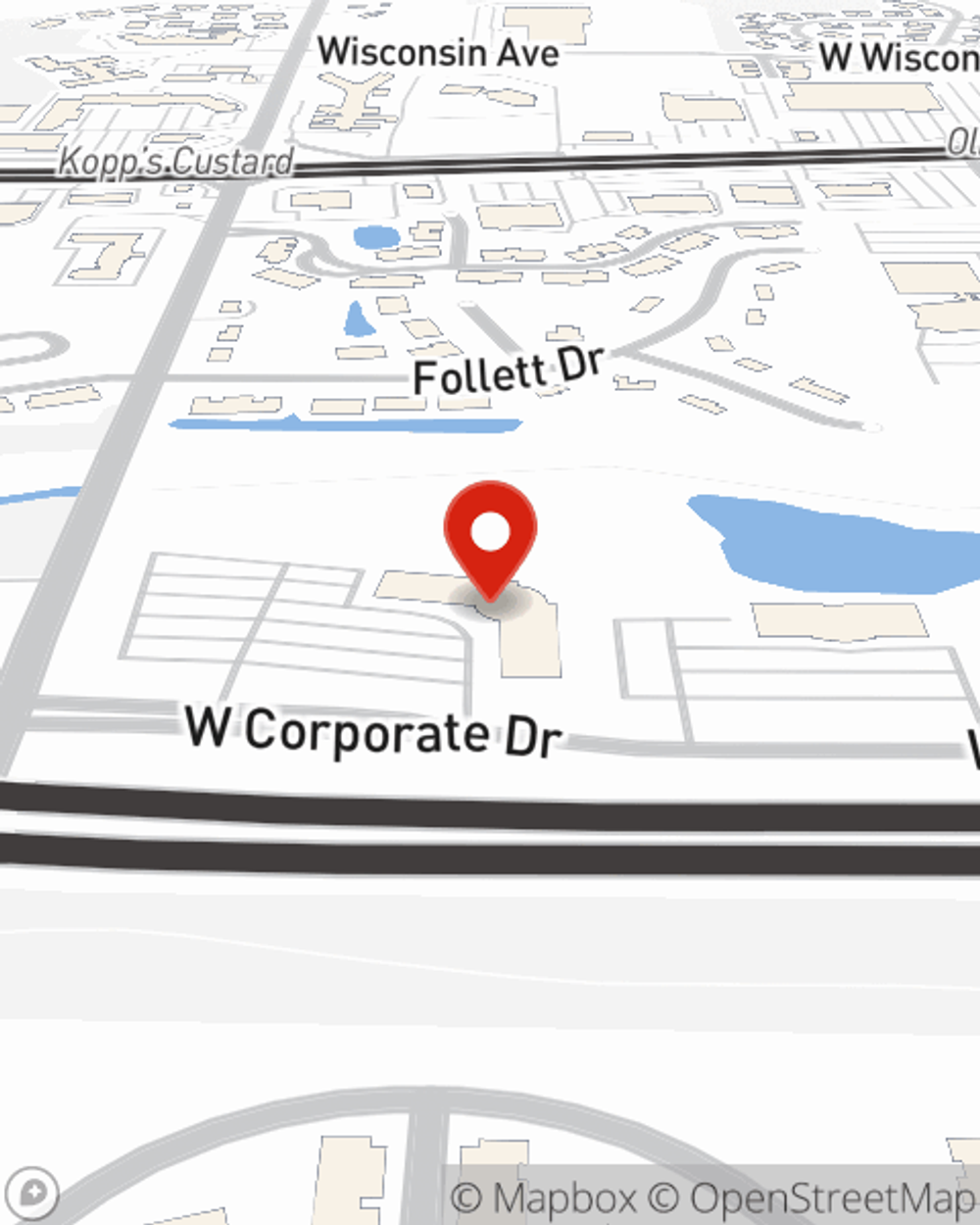

Condo Insurance in and around Brookfield

Townhome owners of Brookfield, State Farm has you covered.

Insure your condo with State Farm today

Home Is Where Your Heart Is

Your condo is your home. When you want to laugh and play, take it easy and slow down, that's where you want to be with your favorite people.

Townhome owners of Brookfield, State Farm has you covered.

Insure your condo with State Farm today

Put Those Worries To Rest

That’s why you need State Farm Condo Unitowners Insurance. Agent Joe Bonow can roll out the welcome mat to help set you up with a plan for your particular situation. You’ll feel right at home with Agent Joe Bonow, with a no-nonsense experience to get dependable coverage for your condo unitowners insurance needs. Personalized care and service like this is what sets State Farm apart from the rest. Agent Joe Bonow can help you file your claim whenever the going gets tough. Home can be a sweet place to be with State Farm Condominium Unitowners Insurance.

Ready to learn more? Agent Joe Bonow is also ready to help you explore what customizable condo insurance options work well for you. Reach Out today!

Have More Questions About Condo Unitowners Insurance?

Call Joe at (262) 896-0101 or visit our FAQ page.

Simple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Simple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.