Renters Insurance in and around Brookfield

Your renters insurance search is over, Brookfield

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Your rented condo is home. Since that is where you make memories and kick your feet up, it can be beneficial to make sure you have renters insurance, even if your landlord doesn’t require it. Even for stuff like your bicycle, coffee maker, kitchen utensils, etc., choosing the right coverage can insure your precious valuables.

Your renters insurance search is over, Brookfield

Coverage for what's yours, in your rented home

Safeguard Your Personal Assets

Renters often underestimate the cost of refurnishing a damaged property. Just because you are renting a apartment or townhome, you still own plenty of property and personal items—such as a cooking set, couch, tool set, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why buy your renters insurance from Joe Bonow? You need an agent who can help you examine your needs and evaluate your risks. With wisdom and dedication, Joe Bonow stands ready to help you keep your things safe.

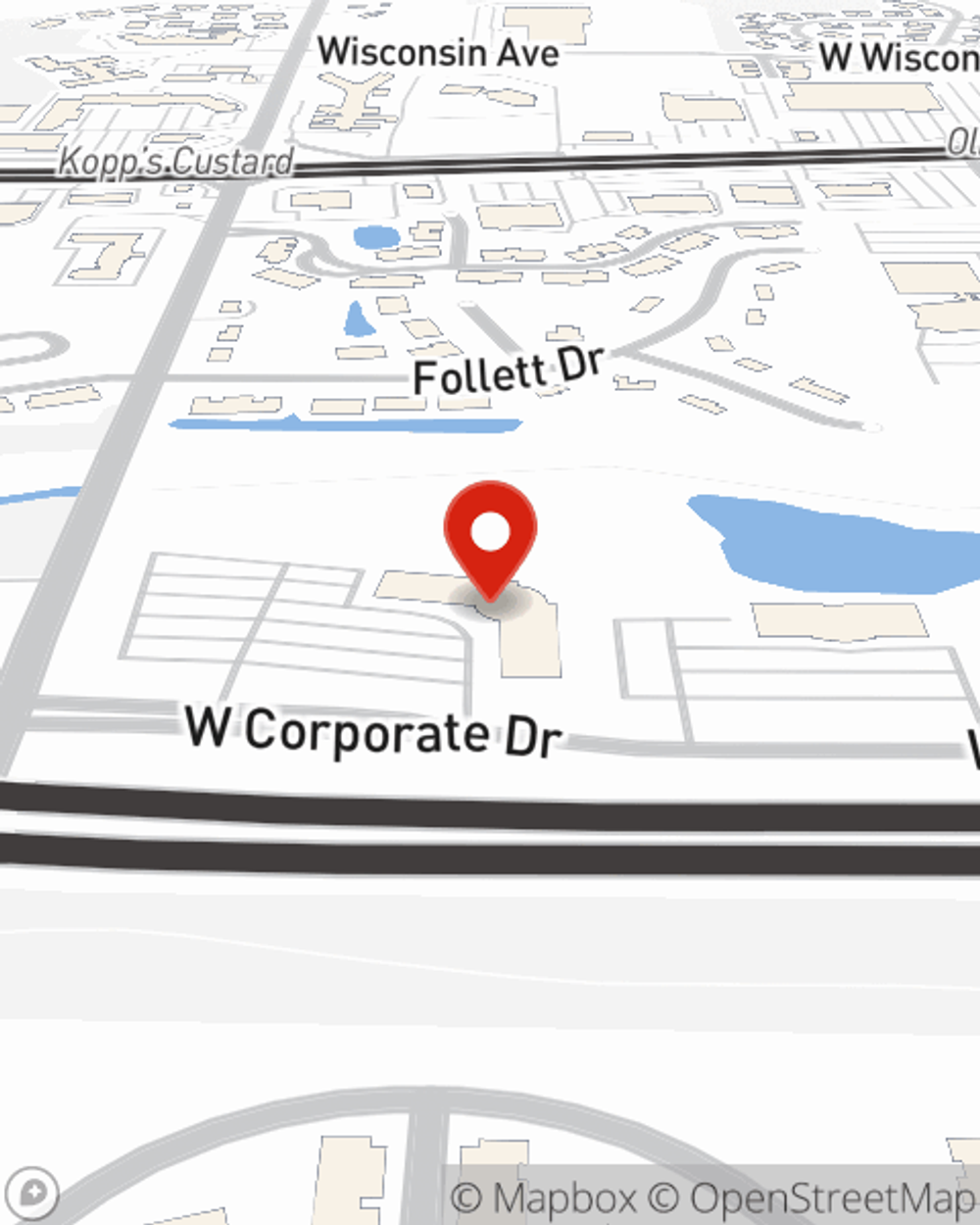

Get in touch with Joe Bonow's office to learn more about the advantages of State Farm's renters insurance to help keep your valuables protected.

Have More Questions About Renters Insurance?

Call Joe at (262) 896-0101 or visit our FAQ page.

Simple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Simple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.